Expertise conundrum (wk 28/2025)

The AI expertise conundrum; strong winds and forest fires, frosty fingers, household goods, tuna collar; animal chiropractors, making clothing in various places, exceptional R&D contractors.

Hello friends,

An announcement: idk, the first (and frankly, the only) training tool for productive discomfort, is back in stock for US shipping addresses.

Early this week, strong winds turned a small automobile fire on the autoroute into a wildfire that consumed 750 hectares of forest just north of Marseille. We were en route to the Marche aux Puces when the fire really got going. Wood ash blew into the poky Maghrebi traiteur we ended up in, and onto lunch (stuffed peppers).

Apart from that, the South finally cooled down during the week. It became possible once more to do things like write without thinking only of frosty drinks and sleep well at night. Some nights got cold enough that the sea surface temperature dropped enough that I got frosty fingers after a 30-minute swim at Catalans on Thursday.

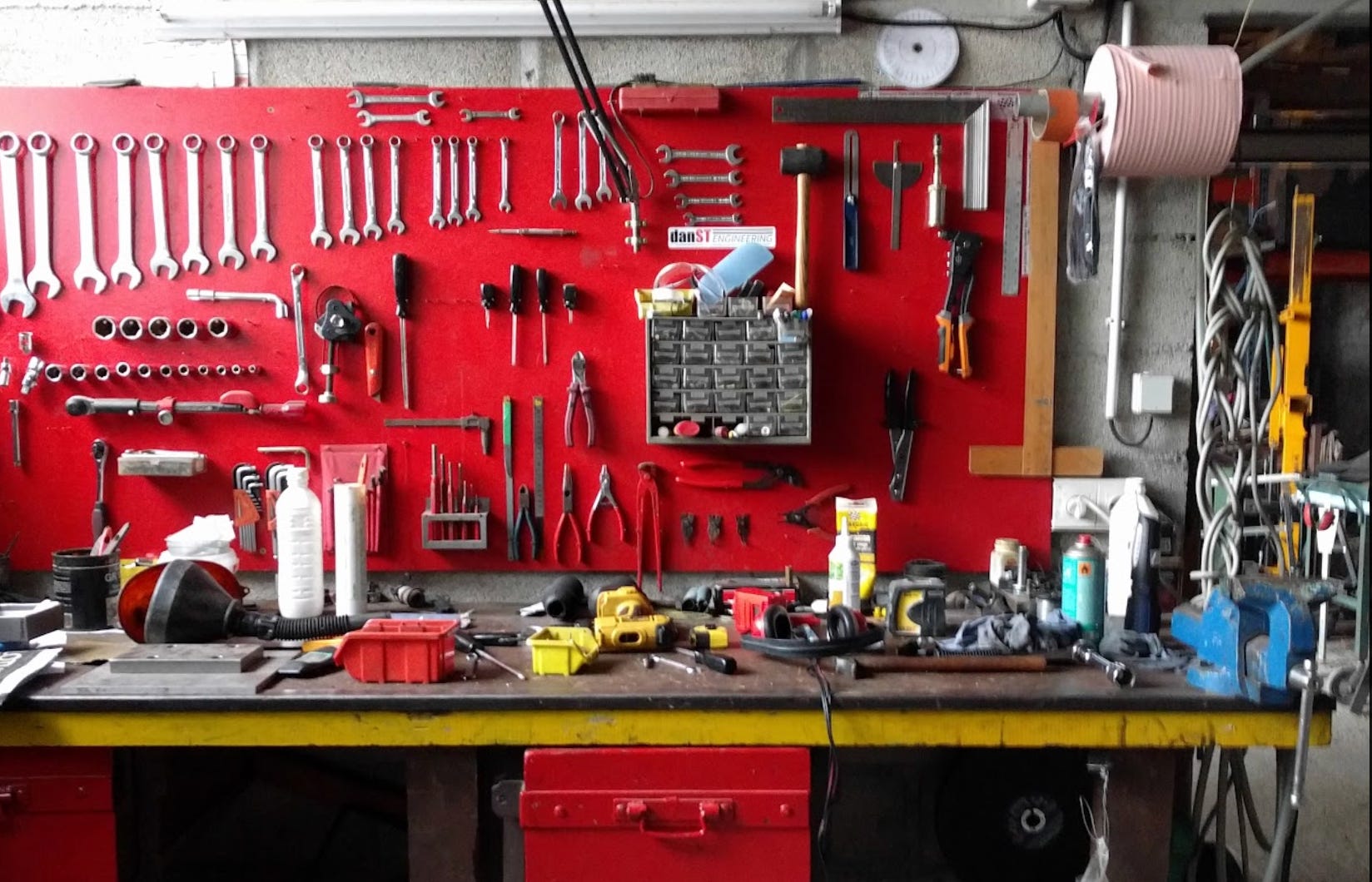

On Friday, I went up to the Luberon to see some friends who have run an opinionated select shop for decades. It is very restful to visit a house in which nearly every object that can be seen and used has been chosen to be well-made (not the same thing as expensive). Equipping and furnishing a house can be a multi-year series of meaning-making acts.

Then, perhaps unwisely, I picked up a tuna collar at the Vieux-Port on Sunday, and spent far too long breaking it down incompetently and without supervision.

Writing

Over the last few months, I’ve had increasingly frequent fascinating conversations with different people about the possibility of a different model of human-machine interaction that accommodates the particular seductions of AI systems. Sounds theoretical, but actually has immediate practical implications on how to build AI tools. Anyway, I wrote something this week about the AI expertise conundrum:

Current LLMs can’t truly or create new knowledge on their own; but they can help humans do that innovation work more quickly. LLMs work best as eager but inexperienced research assistants: good at mapping known landscapes, bad at deciding what matters. So, paradoxically, they’re most useful to people with enough domain expertise to ask good questions and spot flaws — but they leave novices vulnerable to plausible but biased or simply incorrect outputs. If your organisation is deploying AI as a creativity engine or innovation driver … maybe reconsider? The smarter approach: Design AI use around its real affordances (information synthesis, not autonomous creation) and build AI workflows that keep human meaning-making at the centre.

👉 Read more here about the AI expertise conundrum. Elsewhere

On farm animal chiropractors: ‘“This isn’t a replacement for traditional veterinary medicine,” said Stief. “But I will say I think the veterinary field — just like human medicine has — is getting more open-minded and holistic in its approach. I’ve never had a veterinarian respond poorly to the work I do … An animal that feels better in their body is going to have lower cortisol levels, it’s going to feel better, it’s going to digest its food better and so what you’ll notice is an animal — whether it’s a farm animal or a horse — is that if it feels better, you’re going to see overall improvement in the quality of life, whether you’re measuring performance or digestion, you’re going to see changes as that body falls back into homeostasis and balance.”’

On making clothing in the US (and elsewhere): “It's not just custom tailoring. South Korea is unique in that it's full of small, independent brands that are doing cool things — Frizmworks, Document, Eastlogue, etc. These brands are unusual in that they offer distinct designs at relatively affordable prices … South Korean factories are happy to work with smaller brands, who only require small runs. The wages are also lower than many parts of the world. In China, wages are relatively low, but factories require big runs … The combination of low wages + small minimums means that tiny, independent brands can say "hey make this weird robe coat or military parka that I think only level 100 menswear nerds will buy." The item ends up being unique enough to be interesting, but affordably priced to sell.”

On the value of exceptional R&D contractors: “Exceptional contractors … shared three distinct traits, rarely found together. [Each exceptional contractor:]

Was novelty-seeking, with a strong preference for projects that pushed the technological frontier forward substantially.

Built useful technology for actual users. This entailed professional contract management and a willingness to focus on difficult systems engineering tasks.

Used more flexible team structures than academia. When compared to academia, they more effectively hired, organized, and incentivized researchers, engineers, and other experts to collaborate on applied projects in a common-sense fashion.”

See you next week,

VT